Harmoney announces 1H FY21 results

Harmoney announces Q2 FY21 rebound in lending demand and significant growth post half-year end in Australia

Sydney / Auckland, 24 February 2021

ASX / NZX release

HARMONEY ANNOUNCES 1H FY21 RESULTS

Q2 FY21 rebound in lending demand and significant growth post half-year end in Australia

Highlights

- Pro forma revenue of NZ$42m, in line with 1H20

- Cash NPAT of NZ$1.2m, an increase of $4.0m on 1H20

- Loan originations of NZ$194m, exceeding Prospectus forecasts, with 47% growth in Q2 FY21 vs Q1 FY21

- Credit quality continues with 90+ day arrears declining to a historical low of 0.60%

- Operating leverage track-record continues with cash OpEx at ~19% of pro forma revenue

- Group now has over $290m in undrawn warehouse funding limits

- New Zealand warehouse – second facility of up to NZ$200m established

- Australian warehouse – “Big 4” bank approval received to increase facility limit by AU$62m to AU$177m to support Australian growth

- Continued technology investment in proprietary Stellare™ platform and the release of a new, Australian-centric lending model (Libra™ 1.7) post half-year end is generating ~100% growth in new originations in first two weeks

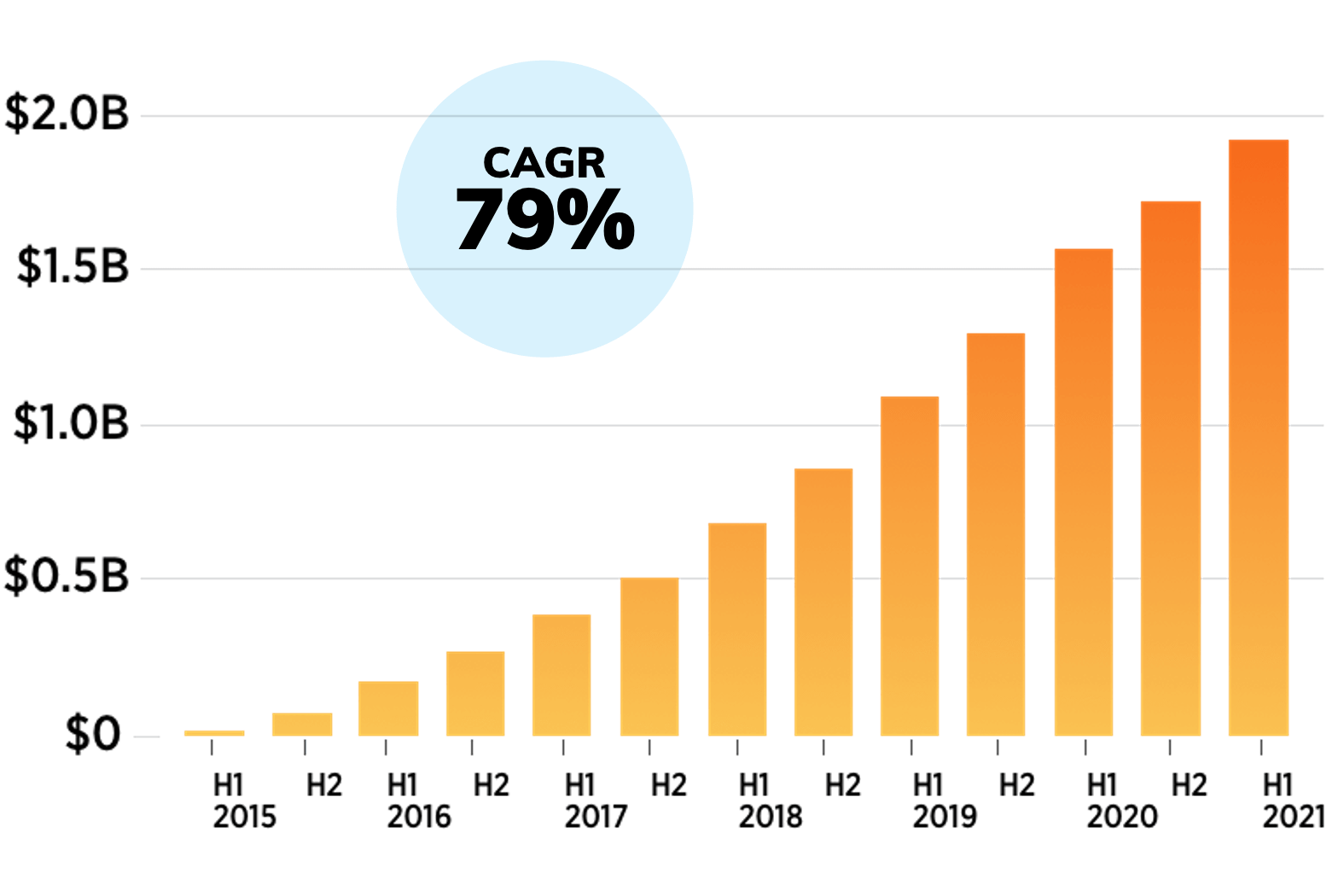

- Harmoney has originated over NZ$1.9 billion in personal loans at a CAGR of 79% whilst maintaining a net interest margin of ~11%

Harmoney Corp Limited (ASX:HMY) (Harmoney or the Company), Australasia’s largest online direct personal lender, announces first half financial year 2021 (1H21) results for the six months ended 31 December 2020.

During the period, Harmoney delivered pro forma revenue of NZ$42m and Cash Net Profit After Tax of NZ$1.2m. Total loan originations delivered were NZ$194m for the period, a decrease of 28% on 1H20, reflecting the deliberate tightening of credit underwriting in a COVID-19 environment. Despite the macro economic uncertainty, the average loan book size was NZ$477m, down only 2% on 1H20. Customer receivables ended 1H21 at NZ$468m, increasing to $NZ481m as at 23 February 2021 with strong demand continuing into the current period.

Loan origination rebounded strongly during the Q2 FY21, with 47% quarter-on-quarter growth, driven by new customer acquisition, particularly in Australia, with the resumption of marketing expenditure following Harmoney’s IPO and as consumer confidence returns. Commenting on the result, CEO and Managing Director, David Stevens, said:

“Harmoney continues to build on the growth momentum happening in Australia through focusing on conversion of accounts while consolidating our growth to date in New Zealand. IPO proceeds were only received in late November 2020 so the impact of the investment is now starting to be realised and will continue into the current half. We are pleased with our progress in 1H21, with stable revenues, cash profit, and the return of loan origination momentum in what is a tale of two quarters.

The second quarter shows a really strong rebound in lending demand, as well as significant growth in new customer originations which are up by 127% on the first quarter. Looking at the Australian market, new loan originations topped $10m in the second quarter which is a growth rate of 207% on the first quarter. This momentum has continued into the current period, and significantly accelerated with the release of Libra™ 1.7.

Our relatively small presence in Australia is considered to be our most significant growth prospect. When applying our New Zealand conversion metrics to the Australian market, today it would be generating lending volumes of $1 billion per annum – and that is a target we are focused on.

We are really excited about the release of Libra™ 1.7 – our first Australian-centric lending model that benefits from years of data-driven accuracy and efficiency in generating new loans. Since it launched on 10 February 2021, we have seen new loan originations up ~100% in just two weeks. This has generated a huge amount of confidence in our ability to match a similar growth trajectory in Australia as already achieved in New Zealand, in a sector that is valued at over $150 billion which is ten times that of the New Zealand market. As the only fully digital direct lending platform in the market, Harmoney continues to innovate the borrowing experience so that we not only attract and convert more consumers, but also drive the structural shift toward more flexible and convenient personal finance service for consumers.”

Pro Forma Financial and Operational Performance

| NZ$'000 | 1H20 | 1H21 | variance |

|---|---|---|---|

| Total Income | 41,553 | 41,554 | flat |

| Cash NPAT after tax | (2,727) | 1,242 | $4.0m |

| Loan Originations | 270,421 | 193,675 | (28%) |

| Loan Book (average) | 486,557 | 477,042 | (2%) |

| Loan Book (period end) | 499,348 | 468,186 | (6%) |

| Net interest margin | 9.5% | 10.9% | 15% |

| Net lending margin | 5.4% | 7.2% | 33% |

During 1H21, the Group recorded total income of NZ$42m which is in line with 1H20, despite this half being a COVID-19 impacted trading period. Cash NPAT was NZ$1.2m, an increase of $4.0m on 1H20 which is a function of Harmoney’s comparatively strong net operating margin, reduced marketing spend, and lower funding costs.

Net interest margin of ~11% is maintained, improving on 1H20 as the Group transitions toward 100% warehouse funding from historic peer-to-peer funding, driving significantly greater income and profitability per loan to Harmoney.

Harmoney’s loan portfolio continued to demonstrate strong credit performance with arrears and losses at historic lows. As at 31 December 2020, group 61+ day arrears declined to 1.3% down from 1.6%, and 90+ day arrears also declined to 0.60% down from 0.98% as at 30 June 2020. Impairment expenses were down 13% in line with the improved arrears. Only ~1% of the total portfolio remain on a payment holiday.

In aggregate, Harmoney has originated over NZ$1.9 billion in personal loans, growing at a CAGR of 79%, and has served more than 48,000 customers across Australia and New Zealand.

Operating leverage track-record continues with cash operating expenditure at ~19% of pro forma revenue.

Harmoney’s 3Rs business model (Return, Repeat, Renew), which seeks to maximise customer retention and lifetime value with data-led offers to existing relationships, was effective in driving quality originations during the half, particularly during Q1 FY21, as Harmoney reduced its marketing expenditure to total income to 14%, down from 17% in 1H20.

Other operating expenses were down 7% or NZ$0.7m, on disciplined cost control, with further operating efficiencies being delivered from automation and a flat fixed cost base, enabled by Harmoney’s 100% online business model.

Diversified Funding

During the half, Harmoney was successful in establishing its second New Zealand warehouse funding facility of up to NZ$200m with M&G Investments. Post half-year end, Harmoney’s Australian warehouse facility received “Big 4” bank approval to increase the facility limit to AU$177m (from AU$115m) to support further growth in this market.

Combined, Harmoney’s facilities provide total warehousing capacity of NZ$353m and AU$177m (NZ$541m total), while significantly reducing Harmoney’s funding costs. Harmoney currently has over NZ$290m of undrawn funding limits, providing strong capacity for growth and supporting the transition of the balance sheet to 100% warehouses, which is now 45% transitioned and expected to largely complete over the next 12 months.

Outlook for Growth

Harmoney’s proprietary loan management system, Stellare™, is unrivalled in its competency and has been architected in a way that allows the Company to adapt its core technology to support new initiatives – such as Libra™ – with modest incremental investment.

Launched on 10 February 2021, Libra™ 1.7, is Harmoney’s new generation, real-time behavioural credit decisioning process and pricing engine. Built specifically for the Australian market, Libra™ 1.7 benefits from years of consumer data that has achieved billions in loan applications across Australia and New Zealand, where Harmoney has operated since inception. This is the first release in a series of five planned releases.

In Australia, Libra™ 1.7 has generated ~100% growth in new loan originations in just 2 weeks since its release. Turbocharging this momentum with the 3R business model means Australia has the potential to be a A$1bn origination per annum business, taking Harmoney’s customer scale to the next level.

Commenting on the outlook for growth, CEO David Stevens added:

“Harmoney is a trusted brand and the largest 100% direct online personal loan lender in the Australasian region. The business is well positioned for more growth with a strong balance sheet, efficient operating systems, and a highly experienced team of data scientists and technologists. We have over NZ$290m in undrawn funding limits and will continue to attract and convert more consumers through our competitive risk-based pricing. We are confident we have the right strategies underway to deliver long term shareholder value while ensuring we continue our vision of creating a frictionless finance experience for consumers.”

ENDS

This release was authorised by the Board of Harmoney Corp Limited.

This release should be read in conjunction with the Appendix 4D and 1H21 investor presentation, also lodged today.

A teleconference will be held at 09:00am AEDT on 24 February 2021. Participants can dial in using the following numbers, quoting the conference ID provided:

| Participant toll: +61 2 8038 5221 Participant toll-free: 1800 123 296 (AU) Participant toll-free: Conference ID: 0800 452 782 (NZ) Conference ID: 4475585 |

| To ask a question, participants will need to dial “*1” (star, 1) on their telephone keypad. |

| International dial-in details: these numbers are toll-free dial-in numbers for each country listed below. For countries not listed below, the Australian Participant Toll number listed above can be dialled. To ask a question, participants will need to dial “*1” (star, 1) on their telephone keypad. |

| Canada: 1855 5616 766 China: 4001 203 085 Hong Kong: 30082034 India: 1800 2666 836 Japan: 0120 994 669 Singapore: 800 616 2288 United Kingdom: 0808 234 0757 United States: 1855 293 1544 |

About Harmoney

Harmoney is an online direct personal lender that operates across Australia and New Zealand providing customers with unsecured personal loans that are easy to access, competitively priced (using risk-adjusted interest rates) and accessed 100% online.

Harmoney’s purpose is to help people achieve their goals through financial products that are fair, friendly, and simple to use.

Harmoney’s proprietary digital lending platform, Stellare™, facilitates its personalised loan product with applications processed and loans typically funded within 24 hours of acceptance by the customer. Stellare™ applies a customer’s individual circumstance to its data-driven, machine learning credit scorecard to deliver automated credit decisioning and accurate risk-based pricing.

Business fundamentals

- Harmoney provides risk based priced unsecured personal loans of up to $70,000 for three, five or seven year periods to customers across Australia and NZ

- Its direct-to-consumer and automated loan approval system is underpinned by Harmoney’s scalable Stellare™ proprietary technology platform

- A large percentage of Harmoney’s originations come from 3R™ (repeat) customers

- Harmoney is comprised of a team of ~80 full-time employees across Australia and New Zealand, over half of whom comprise engineering, data science and product professionals

- Harmoney is funded by a number of sources including two “Big-4” bank warehouse programs across Australia and New Zealand and a facility from M&G Investments